The Binance Coin was able to free itself from its hole at $ 200. Within just 8 days, the price rose to 300 and could now even rise to 400 US dollars.

The year is 2017: The central crypto exchange Binance goes on the market and presents a new concept for an exchange coin. Less than 5 years later, the coin price is at 280 US dollars, and at its best it could even shine with a price of almost 700 US dollars.

Can the coin build on the 50 percent increase within 8 days?

Binance fundamentals point to good development

No wonder that the coin is performing so well, investors will think: there is the largest exchange in the world behind it. Although this argument cannot be disputed, there is another factor behind the success. The BNB chain –Build and Build chain) – formerly consisting of two chains.

An incredible 155 million addresses cumulated to 3.35 billion transactions use the BNB chain – and the trend is rising. With around 180,000 active users, the chain is still lagging significantly behind its main competitor Ethereum with 450,000 active users, but the gap is getting smaller and smaller. The active users include those addresses that have received or sent cryptocurrencies on the chain in the last 24 hours.

The adaptation of the chain and the underlying coin are therefore progressing at a rapid pace. A clear indicator of a long-term price increase.

A constantly evolving ecosystem

The fact that the rules on the blockchain are set by the largest crypto entity in the world has advantages in terms of decision-making. Binance’s cash reserves also make it possible to increase marketing immensely compared to the competition.

Although the central exchange is largely decoupled from the ”decentralized” chain, some developments on the exchange play an important role in the price of the coin.

For example, there has been the possibility to mine your NFTs on the platform on the ETH or BNB chain for a few days. Not obvious at first glance, but such offers spark the demand for the Binance Coin in addition.

Another indicator of an increase in the price.

In addition, it was the exchange that set the rules for the coin in 2017. Investors could consider the coin predestined for an exponential price development for the following reason: the built-in automatic burn mechanism “burns” a predetermined number of coins every quarter, which are taken out of circulation forever.

This procedure guarantees that the number of coins in circulation will decrease by half in the future. In view of the burn taking place in October, there is also a clear indicator of a price increase here.

DeFi is being expanded, social sentiment is positive – Is the price increase now coming to $ 400?

Apart from the central entity, the decentralized ecosystem is also evolving: 446 protocols currently bind a total value Locked (TVL) of 5.51 billion US dollars. This puts the chain in 3rd place behind competitors Ethereum and Tron. The largest platform is the Exchange PancakeSwap with around 3.15 billion TVL.

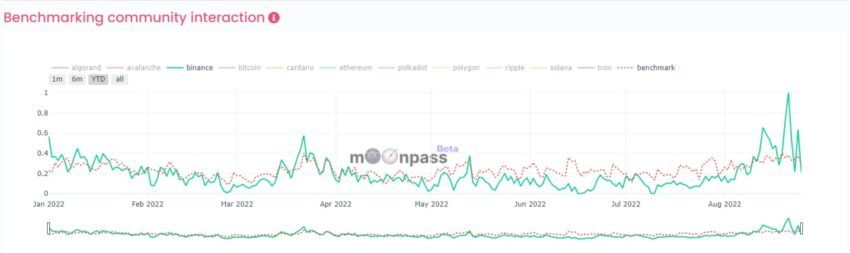

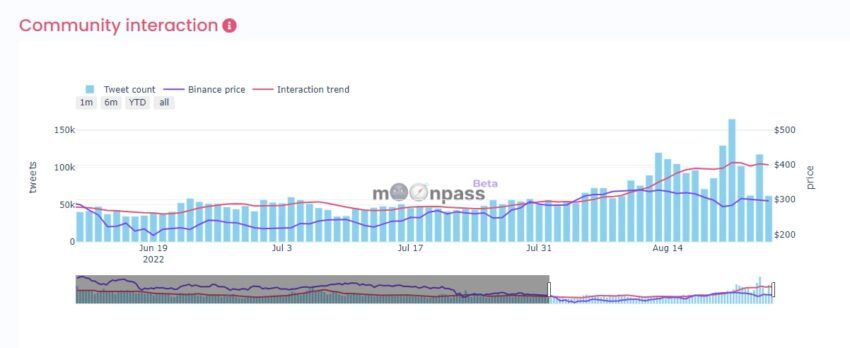

In addition, the young Berlin startup Moonpass has been able to establish connections between price development and interaction rates in social media in the past. This also happened two weeks ago with the Binance Coin. The start-up predicted an increase in the price, which then actually followed. Now the company assumes a fair price of 400 US dollars per coin.

It is easy to see in the picture the increased interaction rate (green) in mid-August, which was followed by a price increase from 200 to 300 US dollars. Although the interaction on social media is flattened again, it is still higher than average. The following picture shows the fair price during the current interaction.

Due to corresponding successes in the past, the company expects to see a further increase.

So could we soon see the Binance coin at $ 400?

Disclaimer

All information contained on our website is researched to the best of our knowledge and belief. The journalistic articles are for general information purposes only. Any action taken by the reader on the basis of the information found on our website is done exclusively at his own risk.